30+ mortgage points tax deduction

Ad Start Your Cash-Out Refinance Sooner See If You Qualify Today. Get Your Max Refund Guaranteed.

Are Mortgage Points Tax Deductible

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

. Web Yes you can deduct points for your main home if all of the following conditions apply. The biggest items would be the deduction of mortgage insurance. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Theyre discount points see the definition The mortgage is used to. Ad Dont Leave Money On The Table with HR Block. With a 15-year loan you deduct one-fifteenth.

Web Points you pay on a mortgage for a second home can only be deducted over the loans life not in the year you pay them however. Web 1 day agoYou cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16. Mortgage discount points also known as prepaid interest are generally the fees you.

Ad Take Advantage of Low Fixed Mortgage Rates Before Its Too Late. Web Unless you are paying more in mortgage deduction than 12950 for a single person or 25900 for joint filers you are not going to get anything back. Web With a 30-year mortgage you deduct one-thirtieth of the cost of the points each year.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Calculate Your Mortgage Payments With Our Calculator And Learn How Much You Can Afford. Web Discount Points Deductions Mortgage points which are also known as discount points are fees that home buyers pay to lenders for a lower interest rate.

Web Most homeowners can deduct all of their mortgage interest. Web Points are prepaid interest and may be deductible as home mortgage interest if you itemize deductions on Schedule A Form 1040 Itemized Deductions. On a second home points can only be deducted over the life of the loan.

Web Employee Tax Expert. Ad Dont Leave Money On The Table with HR Block. Ad Take Advantage of Low Fixed Mortgage Rates Before Its Too Late.

However higher limitations 1 million 500000 if married. Our Tax Pros Have an Average Of 10 Years Experience. Are You Looking For The Best Interest Rate For Home Refinance For Your Home.

Web Hancock Askews tax pros will take calls from 1130 am. The same is true for refinances except in cases where. Our Tax Pros Have an Average Of 10 Years Experience.

Homeowners who bought houses before. Web About Tax Deductions for a Mortgage. Get Your Max Refund Guaranteed.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Points Deduction Itemized Deductions Houselogic

How To Deduct Mortgage Points On Your Taxes Smartasset

Should You Pay Points To Get A Lower Mortgage Rate Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Home Mortgage Loan Interest Payments Points Deduction

What S The Speed Limit In Germany Quora

Mortgage Interest Tax Deduction What You Need To Know

Ex 99 1

Home Mortgage Loan Interest Payments Points Deduction

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

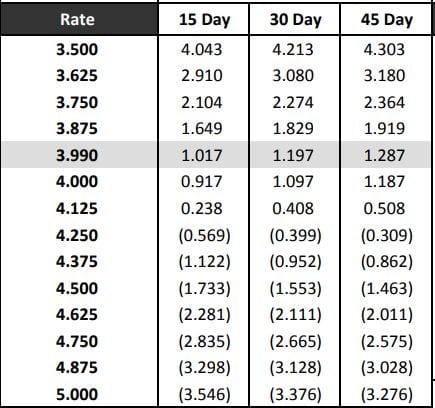

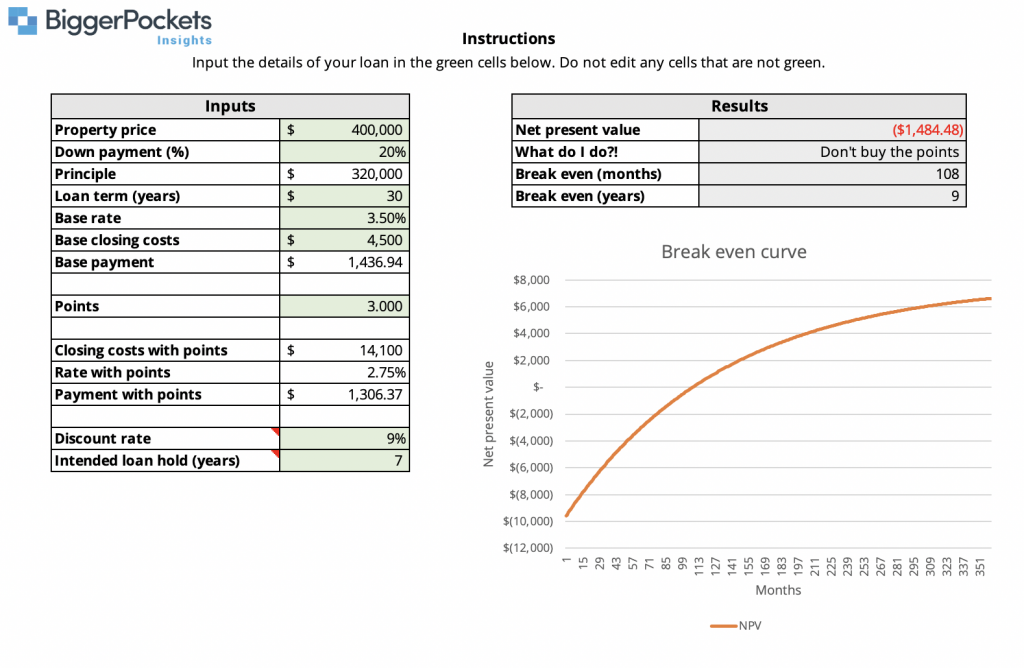

Discount Points Calculator How To Calculate Mortgage Points

Transunion Monthly Industry Snapshot

Should You Pay Mortgage Discount Points

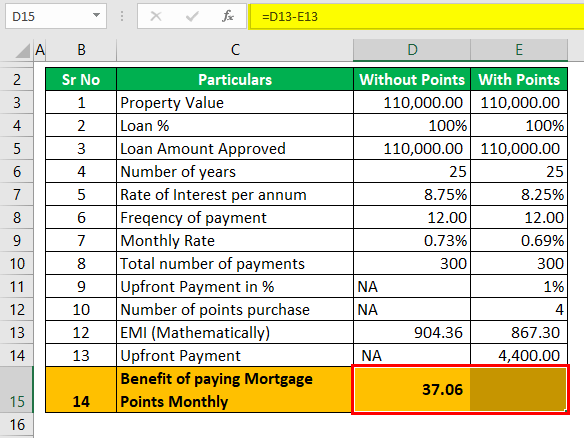

Mortgage Points Calculator Calculate Emi With Without Points

34 Tips On Small Business Tax Deductions And What To Claim

50 30 20 Rule For Budgeting Britannica Money